This post is an impatient person’s guide to setting and achieving big financial goals without losing heart. Settle in, friends. We’re in this for the long haul.

We’ve all heard it—patience is a virtue. And if it were your only measure of virtue, you might conclude that I’m not a very virtuous person. When I was little, my nickname was “Demanda”. While I think I can safely say that I’m not nearly as much of a brat as my little kid self was, it’s also a fair assessment to say I am not the world’s most patient person.

When I set goals, I want to go for them. Like now. Why not now?! I like now.

This is not to say I’m rash. I’m actually a pretty adept planner. I always weigh my options carefully. But once I’ve decided on a course of action, I usually choose to act deliberately. There’s no reason to wait. Let’s get things going!

Despite my eager attitude, here’s a truth about money—money is slow. Financial goals—especially big financial goals—don’t happen overnight.

Here are just a few examples of slow grow financial goals you might have:

- Pay off your student loans

- Pay off your credit card debt

- Pay off your car loan

- Set up your emergency fund (3-6 months of expenses)

- Save for a vacation

- Save for a down payment on a house or investment property

Or some of the even bigger ones:

- Save to quit your job and be financially independent

- Save for retirement

Most of these goals require thousands of dollars, if not tens of thousands. And they can take months or even years to accomplish. So how can an impatient person like me set—and achieve—major financial milestones without going crazy? Here are a few of my strategies…

1. Break Big Goals Into Small, Actionable Pieces

When you have a really big goal that is going to take months, or even years, to achieve, it can help to break the big single goal into smaller milestones.

I used this method to complete my dissertation, the large capstone project required to earn your PhD. A dissertation is a major research and writing project. Many people struggle with the process, losing steam or losing heart somewhere in the middle and ultimately taking years to complete it. There are many reasons why it might take years to complete a dissertation, but one thing that slows down a lot of people is that they get overwhelmed with the size of the project and exasperated with how little their efforts seem to move them toward the finish line. In this way, doing a dissertation is a lot like paying off debt. Lots of small efforts will get you there, but it’s hard to see progress when each contribution of time or money only moves you a tiny bit closer to your goal.

I was able to complete my dissertation from start to finish in fewer than 8 months. I kept myself motivated by breaking the big tasks up into smaller pieces and setting personal deadlines for each month. Ultimately it wasn’t that difficult when I broke the things I needed to do into smaller concrete tasks and held myself accountable for making consistent progress on those smaller goals. As long as I met each of my weekly milestones and monthly tasks, I stayed on track to meet my end goal: completing my dissertation by the summer of 2015 so I could accept a postdoc position I had been offered in Southern California.

Doing a dissertation is a lot like pursuing financial goals. A big win goal—like paying off all of your student loan debt—is good to have. But you are more likely to accomplish your goal if you break that big win into smaller, more actionable pieces. Especially if you’re impatient like me, having lots of little wins along the way a toward a bigger goal is a good way to stay motivated.

2. Visualize Your Progress

One strategy that helps people accomplish big goals is tracking or visualizing their progress. My fiancé and I keep a spreadsheet where we track our debt, savings, and investments. Each month, we update our spreadsheet to track how much of our debt we have paid off and how much we have added to our savings accounts or investments. While some months it feels like our progress is annoyingly slow (at least it feels that way to me), we’ve actually made really good progress this year. Since the beginning of 2016, Mr. Frugal PhD and I have paid off 24 percent of our total debts, which include our student loans (we both chose to get our PhD) and a low-interest car loan. The car loan was an unanticipated expense we accrued when an irresponsible driver totaled our 2004 Saturn shortly after we moved to Los Angeles. I might not be patient, but LA drivers make me look like an angel of virtue by comparison.

By tracking our progress on our debt obliteration plan each month, I am able to see that our efforts, while seemingly slow, add up over time. I look forward to updating our spreadsheet at the end of each month, and I’m proud of how far we’ve come. We’ve chosen to track our debts in a spreadsheet, but another great tool for visualizing financial progress is a tool called Personal Capital. I’ll write more about it later, but the quick version is that it’s a free tool where you can track all of your balances—bank accounts, credit cards, loans, and investments—all in one place. We like to use it to see our net worth slowly but steadily rise.

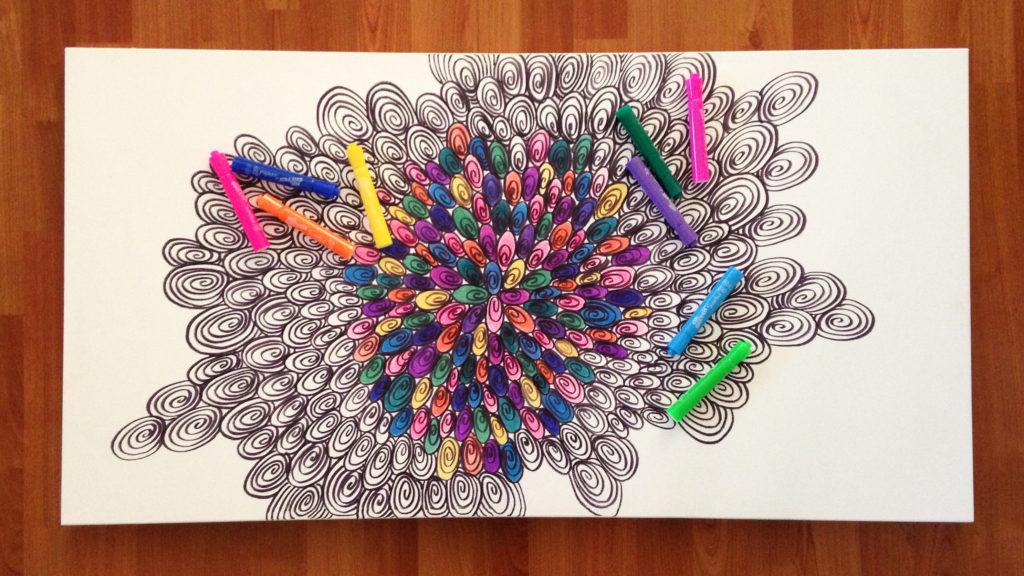

For those who aren’t excited by numbers and spreadsheets, you might be interested in a site called Map Your Progress. There, you can download beautiful images that you color in as you make progress on big goals. Most of their content isn’t free, but you can get a free download by signing up for their mailing list. And even if you don’t choose to buy a progress map, the website is a good source of ideas and inspiration for finding beauty and fulfillment on your journey to accomplishing big financial goals.

It doesn’t matter whether you prefer spreadsheets, online tools, or beautiful coloring sheets. The point is that you make change, no matter how small, visible to yourself. It’s a way of saying, “Good job. You’re getting there.”

3. Celebrate Small Wins

If you implement the strategies above, breaking your big goals up into smaller wins and visualizing your progress, there’s one last thing you can do to keep yourself motivated for the long term: celebrate your small wins. Whether you’ve hit $1,000 in your emergency fund, paid off a milestone percentage of your debts, or consistently kept up your progress for a year, be sure to celebrate the small stuff.

You’ll have to decide what reward will feel meaningful to you. It might be a nice coffee shop latte or a movie date night. Perhaps you’ll splurge on a shirt you don’t really need. Whatever you do, I don’t advise an extravagant reward that will ultimately detract you from your goals. The more persistent you are, the more progress you’ll make over time. But an occasional reward can keep your morale up and keep you from feeling frustrated or impatient. Give yourself permission to be proud of yourself.

If you aren’t tracking, visualizing, and rewarding yourself for your progress, you’ll likely lose sight of how far you’ve come. You’ve got to keep your eyes, and heart, set on that finish line. If I can do it, I know you can too.

If you have other strategies for keeping yourself on track with your financial goals, I’d love to hear about them in the comments.